[ad_1]

13 juillet 2021 – 15 juillet 2021

Publié le : 07 juillet 2021

Entries by admin

Tunisie : Forte baisse des échanges commerciaux en période de Covid-19

[ad_1]

En décembre 2020, les échanges extérieurs ont retrouvé quelque peu leur dynamisme d’avant la-pandémie (Cf. Graph 29). En effet, les exportations ont enregistré une hausse de 3,7% par rapport au mois précédent et de 8,1% sur un an.

Les flux des importations ont également poursuivi leur redressement en enregistrant une progression mensuelle de 7,5%, tirés, notamment, par la hausse des importations des voitures de tourisme.

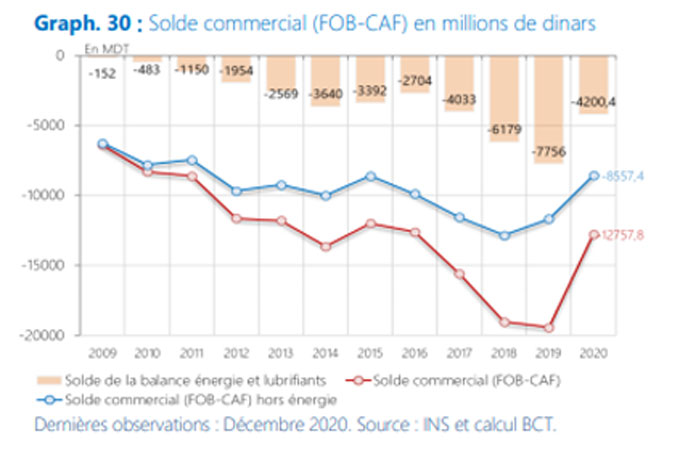

Sur l’ensemble de l’année 2020, les échanges commerciaux se sont soldés par un déficit commercial de 12.758 MDT contre 19.436 MDT en 2019. Cette atténuation découle d’une baisse des importations (-11,8 milliards de dinars) plus prononcée que celle des exportations (-5,1 milliards de dinars). Hors énergie, le déficit de la balance commerciale s’est limité à 8.557 MDT, contre 11.680 MDT à fin décembre 2019 (Cf. Graph 30).

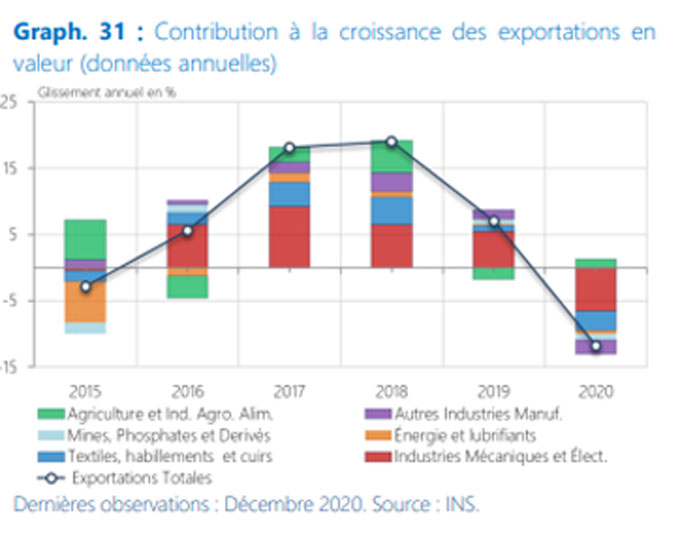

Les recettes d’exportation se sont repliées de 11,7% comparativement aux réalisations d’un an auparavant pour s’établir à 39 milliards de dinars, à fin 2020. Cette baisse a revêtu un caractère quasi-généralisé à l’exception du secteur de l’agriculture et des industries agro-alimentaires (Cf. Graph 31).

En particulier, les exportations, en valeur, du secteur des IME ont chuté de 14% contre une hausse de 12,3% en 2019. Également, les exportations du secteur du THC et de celles des « autres industries manufacturières » se sont repliées de 13,8% et 17,5% respectivement contre des hausses de 4,2% et 12,2% en 2019.

Dans le même sillage, les exportations du secteur des « Mines, Phosphate et Dérivés » ont régressé, durant l’année 2020, de 24,4% contre une hausse de 21,3% un an auparavant, et ce en relation avec l’accentuation des mouvements de protestations et l’arrêt de production dans plusieurs champs miniers.

Également, les exportations du secteur de l’énergie ont accusé une baisse de -9,4% contre une hausse de 3,9% un an auparavant. Par ailleurs, la chute des prix d’huile d’olive sur le marché international d’environ 25%, en 2020, a induit une baisse significative des recettes d’exportation escomptées à seulement 2.300 MDT pour un volume record de vente de 387 mille tonnes (contre 1.387 MDT pour 172 mille tonnes en 2019).

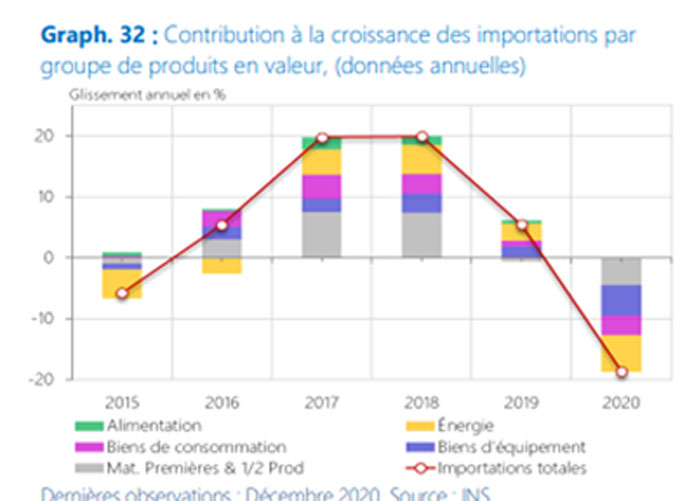

Les dépenses d’importation se sont établies à 51,5 milliards de dinars, en baisse de -18,7% par rapport à 2019. Mis à part le groupe de produit « alimentation », les importations des différents produits ont affiché des baisses généralisées en 2020 (Cf. Graph 32).

Les dépenses d’importation se sont établies à 51,5 milliards de dinars, en baisse de -18,7% par rapport à 2019. Mis à part le groupe de produit « alimentation », les importations des différents produits ont affiché des baisses généralisées en 2020 (Cf. Graph 32).

Par principal groupe de produits, les importations des produits énergétiques se sont contractées de -37,2%, pour avoisiner 6,4 milliards de dinars en 2020. Les importations des « biens d’équipement » des « matières premières et demi-produits » se sont inscrites en baisse pour s’établir à 9,7 milliards de dinars et à 16,8 milliards respectivement contre 12,9 milliards et 19,6 milliards en 2019. Les achats des biens de consommation ont régressé de -13,8%, pour s’établir à 12,9 milliards de dinars.

Toutefois, les importations des produits alimentaires ont enregistré une légère hausse, de 0,6%, pour atteindre 5,7 milliards de dinars, sur l’ensemble de l’année 2020.

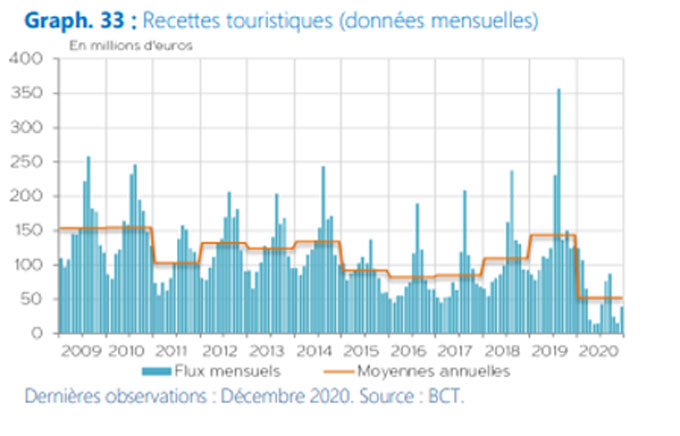

Du côté de la balance des services, le secteur touristique a été durement touché par la pandémie de Covid-19 et les mesures mises en place à l’échelle nationale qu’internationale pour limiter sa propagation. Sur l’ensemble de l’année 2020, les recettes touristiques se sont réduites à 633 M€, en baisse de 63% par rapport aux réalisations d’un an auparavant (Cf. Graph 33).

De leur côté, les revenus du travail (en espèces), exprimés en euros, se sont inscrits en hausse en 2020, pour atteindre un record historique de 1.789 M€ après 1.584 M€ un an auparavant et 1.230 M€ en 2010 (Cf. Graph 34).

De leur côté, les revenus du travail (en espèces), exprimés en euros, se sont inscrits en hausse en 2020, pour atteindre un record historique de 1.789 M€ après 1.584 M€ un an auparavant et 1.230 M€ en 2010 (Cf. Graph 34).

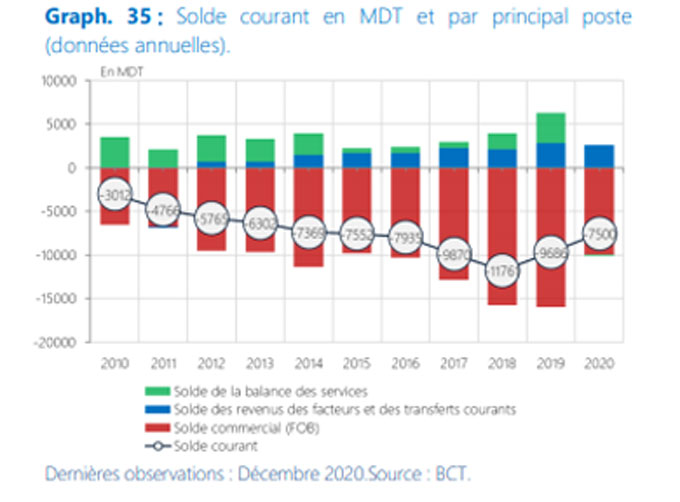

La baisse marquante du déficit commercial (FOBFOB) en 2020 (-9.927 MDT ou -9% du PIB), par rapport à 2019 (-15.955 MDT ou -14% du PIB), a contribué significativement à la contraction du déficit de la balance des opérations courantes.

Ainsi, le déficit courant est revenu de -9.686 MDT (ou -8,5% du PIB) en 2019 à -7.500 MDT (ou -6,8% du PIB) en 2020 (Cf. Graph 35).

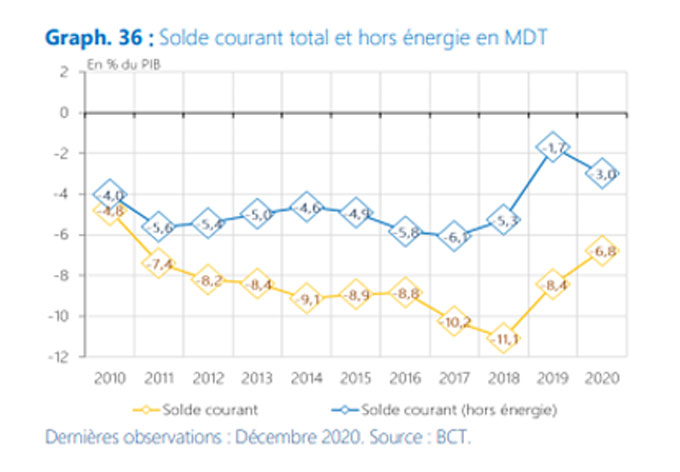

Hors énergie, le déficit de la balance courante s’est toutefois détérioré, en 2020, passant de 1,9 milliard de dinars (ou -1,7% du PIB) en 2019, à 3,3 milliards (ou -3% du PIB) en 2020 (Cf. Graph 36).

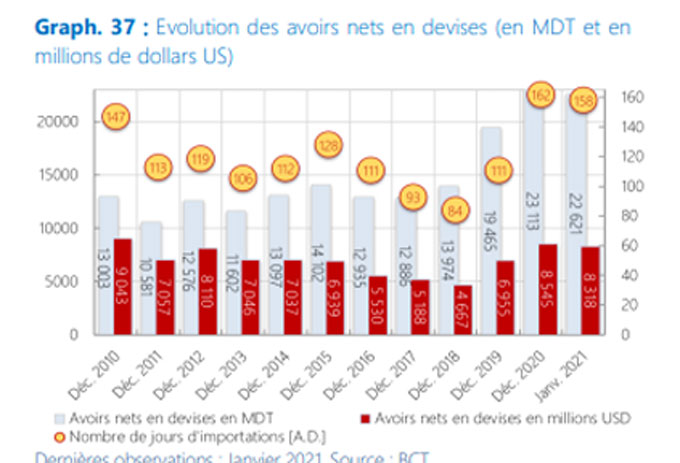

Au niveau des réserves en devises, elles se sont établies, à fin janvier 2021, à 8.318 MUSD (ou 158 jours d’importation), en baisse de -2,7% comparativement à leur niveau de fin 2020 (8.545 MUSD ou 162 jours d’importation) (Cf. Graph 37).

Au niveau des réserves en devises, elles se sont établies, à fin janvier 2021, à 8.318 MUSD (ou 158 jours d’importation), en baisse de -2,7% comparativement à leur niveau de fin 2020 (8.545 MUSD ou 162 jours d’importation) (Cf. Graph 37).

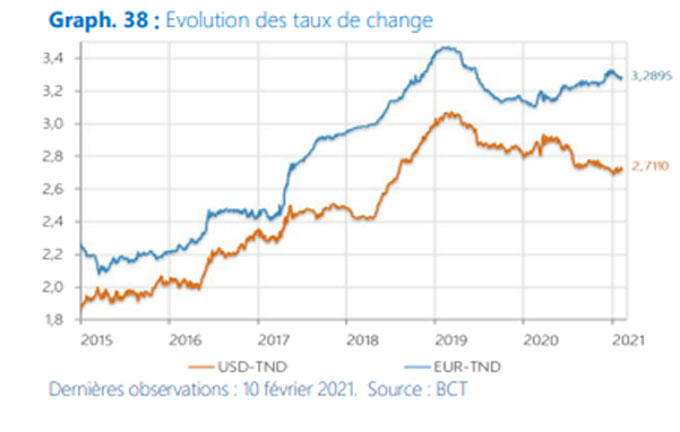

En janvier 2021, le taux de change du dinar vis-à-vis de l’euro s’est apprécié de 0,2% (en m/m) et s’est déprécié de 5,2% (en G.A.). Toutefois, le taux de change du dinar vis-à-vis du dollar américain s’est apprécié de 0,4% en (m/m) et de 4% (en G.A) durant ledit mois (Cf. Graph 38).

Repli du commerce extérieur de la Tunisie aux prix constants, en janvier 2021

[ad_1]

Les échanges commerciaux de la Tunisie avec l’extérieur ont enregistré en volume (prix constants) une baisse de 4,5% des importations et de 7,4% des exportations, au cours du mois de janvier 2021, par rapport à la même période de 2020, selon l’Institut National de la Statistique (INS).

Au niveau des prix, L’INS a fait état d’un repli de 5,9% au niveau des importations et de 0,6% au niveau des exportations dans une note sur le ” Commerce extérieur aux prix constants base 2015 Janvier 2021 “, publiée, mardi.

Les échanges commerciaux de la Tunisie avec l’extérieur en valeurs courantes ont atteint 3655,6MD en exportations et 4626,1MD en importations, en janvier 2021, enregistrant ainsi une baisse de 7,9%, à l’export et une baisse de 10,1%, à l’import, et ce, par rapport à janvier 2020.

Hors énergie, les prix ont baissé à l’export de 6,7% et à l’import de 6,1%, par rapport à janvier 2020.

La baisse en volume des exportations, au mois de janvier 2021, a touché la majorité des secteurs, essentiellement, le secteur des textiles, habillement et cuirs (-14%), le secteur des industries mécaniques, électriques (-3,4%) et le secteur des Mines, Phosphates et Dérivés (-61,8%).

En revanche, les exportations du secteur de l’agriculture et agro-alimentaires ont augmenté, en volume de 3,6%, par rapport au mois de janvier 2020.

Concernant les importations, l’évolution en volume est marquée par une baisse au niveau de la majorité des secteurs, particulièrement ceux des industries mécaniques et électriques (-6,6%), du textile, habillement et cuirs (-6,6%), ainsi que celui des mines, phosphates et dérivés (-21,5%).

En revanche, les importations du secteur de l’agriculture et agro-alimentaires ainsi que ceux du secteur de l’énergie et lubrifiants ont augmenté en volume respectivement de 5,2% et de 3,9%, par rapport au mois de janvier 2020.

Bientôt une base de données commune pour les structures d’import-export

[ad_1]

Une base de données commune entre les différentes structures intervenantes dans le domaine de l’import-export, sera mise en place pour faciliter l’échange d’informations et la prise de décision au moment opportun, a fait savoir, vendredi 26 février, la directrice générale du commerce extérieur au ministère du Commerce et du Développement des exportations, Dorra Borji, dans une déclaration à l’agence TAP.

Cette base de données servira également, à assurer un meilleur suivi des échanges commerciaux de la Tunisie, avec ses différents partenaires, à surveiller l’approvisionnement du marché intérieur et à suivre l’évolution de la situation des marchés extérieurs.

Le recoupement des informations renforcera également, le rôle de l’Observatoire du commerce extérieur, en tant qu’outil de veille et d’anticipation, et lui permettra d’élaborer des analyses approfondies et exhaustives qui contribueront à redresser la situation de la balance commerciale, a-t-elle encore, indiqué.

La responsable a précisé qu’un accord a été trouvé, lors d’une réunion tenue hier jeudi, au siège du ministère, pour former une équipe restreinte représentant les différentes structures (ministère du Commerce, CEPEX, Tunisie Trade Net, Banque centrale, Douane), pour identifier les mécanismes logistiques et techniques, à même d’aider à mettre en place cette base de données et à cerner les besoins des différentes parties prenantes.

Elle a, par ailleurs, souligné que les différentes structures participantes à la réunion de jeudi (BCT, Douane, Tunisie Trade Net , Observatoire National de l’Agriculture, Office des Céréales, Pharmacie Centrale) ont souligné à l’unanimité, la nécessité d’unifier la référence des statistiques pour une meilleure cohérence des données, faisant remarquer que les données sont généralement, échangées d’une manière bilatérale entre les administrations et structures, ce qui favorise leur dispersion et complique leur exploitation.

Forte contraction des échanges extérieurs de la Tunisie en janvier et février 2021

[ad_1]

Au cours des deux premiers mois de l’année 2021, les échanges commerciaux de la Tunisie avec l’extérieur ont enregistré en volume (prix constants), une baisse à l’export de 9,7% et à l’import de 7,3%, par rapport à la même période de l’année 2020, selon une note sur le ” Commerce extérieur aux prix constants février 2021″ publiée vendredi 19 mars 2021 par l’Institut national de la statistique (INS).

Au niveau des prix, l’INS fait état d’un repli de 0,4% pour les exportations et de 5,1% pour les importations.

En valeur courante, les échanges commerciaux de la Tunisie avec l’extérieur ont atteint, au cours deux premiers mois de l’année 2021, 6,839 milliards de dinars en exportations, et 8,733 milliards de dinars en importations, enregistrant ainsi une baisse de l’ordre de 10,1% à l’export et de 12,0% à l’import.

Hors énergie, les prix ont augmenté à l’export de 1,4% et ont baissé à l’import de 0,7% par rapport aux deux premiers mois de l’année 2020.

Au cours des deux premiers mois de l’année 2021, la baisse en volume des exportations a touché tous les secteurs, mais essentiellement ceux du textile/habillement et cuirs (-11,4%), des industries mécaniques et électriques (-8,1%) et des mines, phosphates et dérivés (-49,0%).

Concernant les importations, l’évolution en volume est marquée par une baisse au niveau de la majorité des secteurs, particulièrement le secteur des industries mécaniques et électriques (-7,3%), du textile/habillement et cuirs (-10,3%) et celui des autres industries manufacturières (-13,4%).

Contraction en volume en glissement annuel

Au cours du mois de février 2021 et aux prix constants, les échanges commerciaux ont enregistré une baisse de 9,8% pour les importations et de 11,9% pour les exportations, en glissement annuel.

Les prix des produits échangés sont en repli de 4,3% au niveau des importations et de 0,2% au niveau des exportations.

Aggravation du déficit commercial de la Tunisie au 1er trimestre 2021

[ad_1]

Au cours du premier trimestre 2021, le déficit commercial s’est aggravé pour s’établir à 3,651 milliards de dinars, enregistrant une régression par rapport à sa moyenne trimestrielle (2,864 milliards de dinars) autour de laquelle il s’était établi durant les trois trimestres précédents, selon une note sur le ” Commerce extérieur aux prix courants mars 2021 ” publiée lundi 18 avril 2021, par l’Institut national de la statistique (INS).

Durant le premier trimestre 2021, les exportations ont augmenté de 2,4% par rapport au quatrième trimestre de l’année 2020. Elles se sont élevées à 10,818 milliards de dinars, contre 10,565 milliards de dinars au cours du trimestre précédent.

De même, les importations ont enregistré une hausse de 9% par rapport au quatrième trimestre de 2020.

En valeur, les importations ont atteint 14,470 milliards de dinars, contre 13,280 milliards de dinars lors du trimestre précédent.

Le taux de couverture a donc perdu 4,8 points pour s’établir à 74,8%, contre 79,6% durant le quatrième trimestre de l’année 2020.

Commerce extérieur : Réduction de 423,8 MD du déficit commercial aux prix courants

[ad_1]

Au cours des quatre premiers mois 2021, le déficit commercial s’est établi à un niveau de – 4420,7 millions de dinars (MD), contre – 4844,5 MD enregistré, au cours de la même période de l’année 2020, soit une amélioration de 423,8 MD, selon une note sur le Commerce aux prix courants avril 2021 publiée, vendredi, par l’Institut national de la statistique (INS).

Cette amélioration est expliquée par la hausse des exportations (+21,4%) et celle des importations (+13%). Le taux de couverture a gagné, ainsi, 5,4 points pour s’établir à (77,5%), contre (72,1%), à fin avril 2020.

Sous le régime général, les échanges commerciaux sont déficitaires de -8987,8 MD (-7709,1MD en 2020), alors qu’ils sont excédentaires sous le régime offshore de 4567,1 MD (+2864,6 MD en 2020).

A fin avril 2021, les exportations ont enregistré une hausse de (+21,4%) contre une baisse de (-20,6%) durant les quatre mois de l’année 2020. Ils ont atteint le niveau de 15201 MD, contre 12521,2 MD durant la même période de l’année 2020.

L’INS explique cette hausse, d’une part par l’augmentation enregistrée au niveau des secteurs du textiles/ habillement et cuirs(35%), des industries mécaniques et électriques (34,1%), et d’autre part du secteur des industries manufacturières ( 34,3%), ainsi que de celui de l’ensemble des produits de 21,4%.

En revanche, le secteur de l’agriculture et des industries agro-alimentaires a enregistré une baisse de (-5,5%). De même, le secteur de l’énergie et lubrifiants a régressé de (- 27,5%) et celui des mines, phosphates et dérivés de (-2,2%).

Hausse de 13% des importations

Les importations ont enregistré une hausse de +13%, contre une baisse de 21,5% durant les quatre mois de l’année 2020. En valeur, les importations ont atteint 19621,7 MD, contre 17365,8 MD durant la même période de l’année 2020.

Cette hausse est expliquée par l’augmentation enregistrée au niveau des importations du secteur des mines, phosphates et dérivés de 35,1%, celui des industries mécaniques et électriques de 23,7% et celui de l’agriculture et des industries agro-alimentaires de 16,9%.

De même, les importations du secteur textiles/habillements et cuirs ont progressé de 21,3%.

Par contre, les importations du secteur de l’énergie et lubrifiants ont régressé, au cours des quatre premiers mois 2021 de (-19,7%).

Aggravation du déficit commercial mensuel de la Tunisie aux prix courants

[ad_1]

Le déficit commercial mensuel a augmenté de 92,8 millions de dinars (MDT) en avril 2021 par rapport à mars 2021, pour se situer à environ 1,2 milliard de dinars, selon la note sur “le commerce extérieur aux prix courants (CVS-CEC), avril 2021″, publiée jeudi 27 mai 2021 par l’Institut national de la statistique.

Le taux de couverture en avril 2021 a perdu 1,7 point par rapport à mars 2021, pour s’établir à 77,2%.

Cette aggravation du déficit est due à une baisse des exportations de 1,8%, en raison essentiellement de la chute des exportations des filières agriculture et industrie agroalimentaire (-18,6 %) ainsi que l’énergie et des lubrifiants (-18,3%).

Pour ce qui est des importations, une très légère hausse de 0,4%, est enregistrée, en raison d’une forte augmentation des achats des produits énergétiques (+47,1%).

La note de l’INS a fait état, en outre, de la baisse des exportations avec la majorité des pays, à l’exception de l’Allemagne (+2,5%). Il s’agit notamment de la France (-6,9%) et de l’Italie (-8,2%), entraînant une baisse au niveau européen (-4,7%), mais des pays du Maghreb (-13,2%) et de la Turquie (-46,7%).

Les importations en provenance de l’espace européen ont stagné (+0,2%), contre une amélioration des achats en provenance de l’UMA (+4,7%) et de la Chine (+1,6%). En revanche, un recul des importations est enregistré avec la Turquie (-8,1%).

” Dans cette publication, les chiffres du commerce extérieur sont corrigés sur la base des variations saisonnières et des effets calendaires (jours ouvrables et ceux dus aux événements particuliers du calendrier qu’ils soient fixes, tels que les fêtes nationales, ou variables, tels que le ramadan ou les fêtes religieuses).

Ce traitement permet d’avoir une lecture plus fidèle de la conjoncture, en suivant l’évolution par rapport au mois ou au trimestre précédent”, a précisé l’INS.

Echanges extérieurs de la Tunisie : Seul le textile-habillement a connu une évolution positive en avril (INS)

[ad_1]

Les volumes des échanges extérieurs de la Tunisie ont connu une baisse en avril 2021. En effet, les exportations et les importations en volume ont reculé respectivement de 4,2% et 2,5%, après avoir affiché de fortes hausses au mois de mars 2021, selon la dernière note de l’INS sur le “Commerce extérieur aux prix constants base 2015 – Avril 2021”, publiée mercredi 2 juin 2021.

Avec une baisse plus prononcée en volume d’export qu’en import, le taux de couverture perd un point et demi, pour s’établir à 80,9% pour le mois d’avril.

Les prix poursuivent leur mouvement de hausse, avec un rythme un peu plus soutenu à l’import (+2,9%) que pour l’export (+2,5%).

Baisse du volume des exportations de tous les secteurs d’activité

S’agissant des exportations, tous les secteurs ont enregistré une baisse du volume de leurs exportations, à l’exception du secteur textile habillement et cuir qui a connu une évolution positive de 4,2%.

La baisse en volume (-4.2%) enregistrée au niveau global des exportations provient principalement d’une contribution négative du secteur de l’énergie (-26,2%) et de l’agriculture et des agro-industries (-17,4%).

Pour ce qui est des importations, la majorité des groupes de produits ont participé à cette baisse, à l’exception des produits énergétiques dont le volume s’est accru de 37,8% et les produits alimentaires qui se sont maintenus (+0,7%) par rapport à mars 2021.

Il est à noter que c’est la baisse remarquable de 11,1% enregistrée au niveau du volume des achats de produits de biens de consommation qui a contribué le plus au fléchissement du volume global des importations.

Evolution des échanges hors énergie

Après deux mois d’évolution positive, les volumes des échanges hors énergie marquent une pause et enregistrent des baisses, avec un taux plus prononcé au niveau des importations (-6,4%) que pour les exportations (-1,1%).

Par ailleurs, les prix hors énergie ont enregistré une hausse de 0,6% à l’export et 2,4% à l’import, ce qui a entraîné une baisse des termes de l’échange hors énergie, pour le troisième mois consécutif, de 1,8 point, pour se situer à 94,7%.

Tunisie : Plus de 378 MDT de déficit commercial en mai 2021

[ad_1]

Le déficit commercial s’est creusé de 378,2 millions de dinars en mai 2021, pour s’établir à 1,554 milliard de dinars contre 1,176 milliard de dinars en avril 2021, selon la note mensuelle sur le commerce extérieur aux prix courants de l’Institut national de la statistique (INS).

De ce fait, en mai 2021, le taux de couverture a perdu 7,3 points par rapport à celui d’avril s’établir à 69,8%.

D’après l’INS, les échanges commerciaux de la Tunisie ont chuté en mai pour le deuxième mois consécutif, enregistrant ainsi des niveaux inférieurs de 6% à ceux d’avant pandémie.

Les exportations ont chuté de 9,5%, soit une baisse plus importante depuis le début de l’année. Elle a touché tous les secteurs à l’exception du secteur de l’agriculture et de l’industrie agro-alimentaire qui a enregistré une amélioration de +9,4%.

Les diminutions observées au niveau des exportations du secteur des industries mécaniques et électriques (-14,0%) et celui du secteur textile et habillement (-12,4%) sont celles ayant contribué le plus à la baisse globale.

De même, les exportations du secteur de l’énergie et celles du secteur des mines, phosphates et dérivés ont respectivement reculé de 10% et 4,7%.

S’agissant des importations, elles ont stagné pour le deuxième mois consécutif. L’augmentation de 9% sous le régime offshore est compensée par une baisse sous le régime général (-4,4%).

Selon l’INS, cette stabilité au niveau global des importations est donc la conjonction d’une dynamique au niveau des approvisionnements en matières première et demi-produits (+8,9%) ainsi qu’en produits de bien d’équipement (+10,8%) contrebalancée par une forte baisse des achats de produits d’alimentation (-26,4%) et de produits énergétiques (-11,7%).

Hors énergie, les importations ont enregistré une légère hausse de 1,8%.

Détérioration des échanges avec l’Union européenne

Les exportations vers les pays de l’Union européenne ont enregistré une baisse de 7,9%, due à la régression des ventes vers les principaux partenaires européens tels que la France (-4,6%), l’Allemagne (-12,9%) et l’Espagne (-11,4%).

Les exportations vers la Chine, la Turquie et la Russie ont également baissé respectivement de 58,4%, 65,6% et 19,5%. Cependant, la Tunisie enregistre une reprise de ses exportations vers l’Italie (+5,2%).

De leur côté, les importations ont enregistré une stagnation avec les pays de l’Union européenne (+0,4%), alors que les achats étaient en hausse en provenance de la Chine (+2,5%) et de la Turquie (+10,3%), et en recul avec l’UMA (-14,5%) et la Russie (-45,1%).