Dans le cadre de la coopération économique et commerciale Tuniso-Canadienne, le Ministère du Commerce et du Développement des Exportations informe tous les exportateurs que les autorités Canadiennes ont décidé de réinscrire la Tunisie, à compter du 1er janvier 2025, au sein de l’initiative canadienne relative au Programme de Tarif de Préférence Général TPG, qui annule ou réduit les droits de douane sur les produits Tunisiens exportés vers le marché Canadien. Les vêtements, chaussures et certains matériels agricoles sont exclus de la liste des produits concernés.

Commerce extérieur : Réduction du déficit commercial aux prix courants !

[ad_1]

Le déficit commercial s’est résorbé, en 2020, de 6678,4 millions de dinars(MD) pour s’établir à un niveau de -12757,8 MD contre -19436,2 MD en 2019, selon une note sur le » Commerce extérieur aux prix courants décembre 2020 » publiée, mardi, par l’Institut national de la statistique(INS).

– Publicité-

Il y est précisé que cette réduction est due à une baisse plus forte au niveau des importations (-18,7%) et celui des exportations de (-11,7%).

D’après l’INS, le déficit de la balance commerciale de 12757,8 MD est expliqué en grande partie par le déficit enregistré avec certains pays, tels que la Chine (-5393,8 MD), la Turquie (-2140,6 MD), l’Algérie (-1719,5 MD), la Russie (-1007,1 MD) et l’Italie (-798,4 MD).

En revanche, le solde des échanges de marchandises a enregistré, en 2020, un excédent avec d’autres pays principalement avec la France (3515,9 MD), l’Allemagne (1217 MD) et la Libye (1096,3 MD).

Selon le régime, les échanges commerciaux sont déficitaires sous le régime général de -23760,9 MD (-31249,2 MD en 2019). Toutefois, ils sont excédentaires sous le régime offshore de 11003,1 MD (+11813 MD en 2019).

Hors énergie, le déficit de la balance commerciale s’est réduit à -8557,3MD et le déficit de la balance énergétique s’est établi à -4200,5 MD (soit un tiers du déficit total) contre -7756,4 MD en 2019.

Le taux de couverture a gagné, ainsi, 5,9 points par rapport à l’année 2019 pour s’établir à 75,2% contre 69,3% en 2019.

Baisse des exportations, en 2020, de 11,7%

Durant l’année 2020, les exportations ont enregistré une baisse de (-11,7%) contre une hausse de (+7%) durant l’année 2019. Elles ont atteint le niveau de 38705,9 MD contre 43855,4 MD en 2019.

Ce repli observé concerne plusieurs secteurs. En effet, le secteur des textiles, habillement et cuirs s’est contracté de (-13,8%), celui des industries mécaniques et électriques de (-14%), celui de l’énergie de (-9,4%) et celui des mines, phosphates et dérivés de (-24,4%).

En revanche, le secteur de l’agriculture et des industries agro-alimentaires a enregistré une hausse de (+12%), suite à l’augmentation des ventes d’huile d’olive (2299,7 MD contre 1386,9 MD).

Les exportations tunisiennes vers l’Union Européenne (74,2% du total des exportations) se sont contractées de (-11,3%). Cette régression est expliquée d’une part, par la baisse des exportations tunisiennes vers certains partenaires européens, tels que la France (- 20,8%), l’Allemagne (-15,2%) et l’Italie (- 8%), d’autre part, par la hausse des ventes vers d’autres pays notamment l’Espagne (+37,2%) et la Belgique (+4,3%).

En destination des pays arabes, les exportations ont diminué avec l’Algérie (- 28,8%), la Libye (-20,5%) et l’Egypte (- 13,4%)

Baisse des importations de 18,7%

Les importations ont enregistré, en 2020, une baisse de (-18,7%) contre une hausse de (+5,5%) durant l’année 2019. En valeur, les importations ont atteint 51463,7 MD contre 63291,6 MD en 2019.

Cette diminution est due à la baisse enregistrée au niveau des importations des biens d’équipement de (-24,6%), des matières premières et demi- produits de (-14,5%), des biens de consommation de (-13,8%) et de l’énergie (- 37,2%) sous l’effet de la contraction des achats des produits raffinés (3376,6 MD contre 6416,2 MD) et de gaz naturel (2129,1 MD contre 3691,6 MD). Pour ce qui est des importations, les échanges commerciaux des biens avec l’Union Européenne (49,9% du total des importations) ont enregistré une baisse de (-21,4%) pour s’établir à 25671,8 MD. Les importations ont diminué, en provenance de la France (-26,6%), de l’Italie (-25%) et de l’Allemagne (-16,8%).

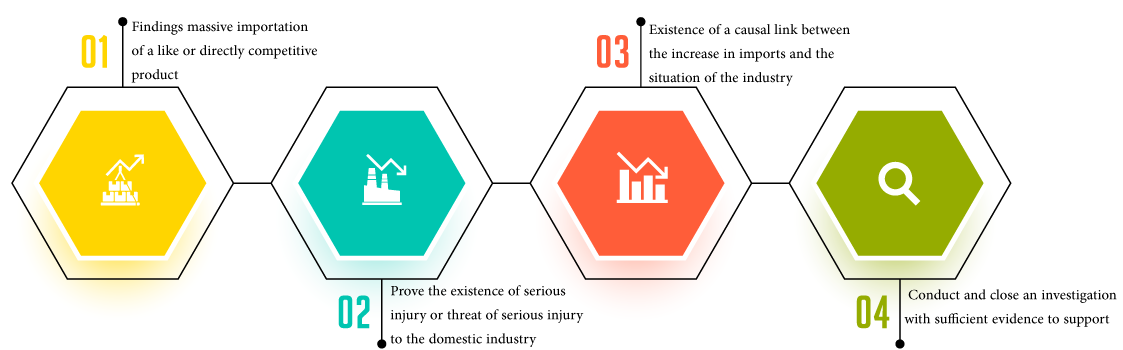

Procedural phases relating to the defense against unfair import practices

The procedural phases relating to the defense against unfair

import practices are defined as follows:

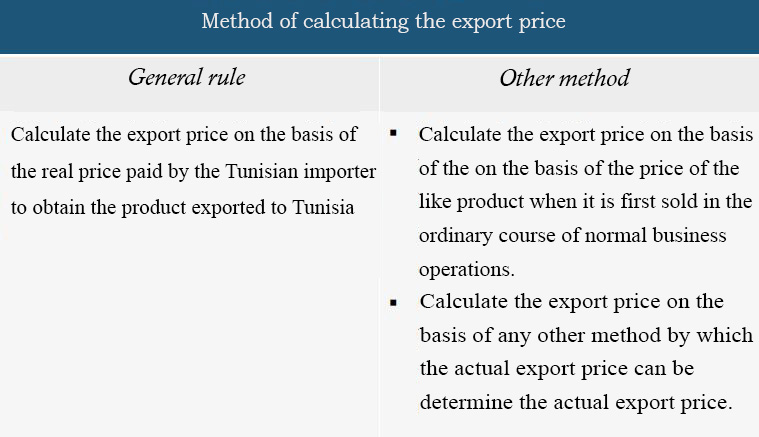

The subsidy

Subsidy is the granting of a benefit to a foreign exporter by the government of the exporting country in the form of a financial contribution that confers a benefit measured against generally applicable trading standards and normal market conditions.

The financial contribution can take one of the following forms:

- A direct transfer of funds (for example a donation, a loan, equity participation)

- A potential direct transfer of funds or liabilities (e.g. a loan guarantee),

- Public revenues that are normally payable are abandoned or not collected (example: tax credits),

- Supplies of goods or services other than general infrastructure, or purchase of goods by public authorities

- Income or price support

Conditions for considering the subsidy as an unfair import practice

For the subsidy as defined above to be considered an unfair import practice, it must be “specific”, i.e. reserved for certain companies or when its granting is not subject to objective criteria or that these criteria, despite their existence, are not respected.

The imposition of countervailing duties can only be applied on the basis of an investigation which has found that the imports in question are subsidized and are causing damage to the domestic industry producing a like product. The damage determination is based on the following positive evidence:

Countervailing duty investigations must cease immediately in cases where the amount of subsidy is de minimis or where the volume of subsidized imports is negligible.

Dumping

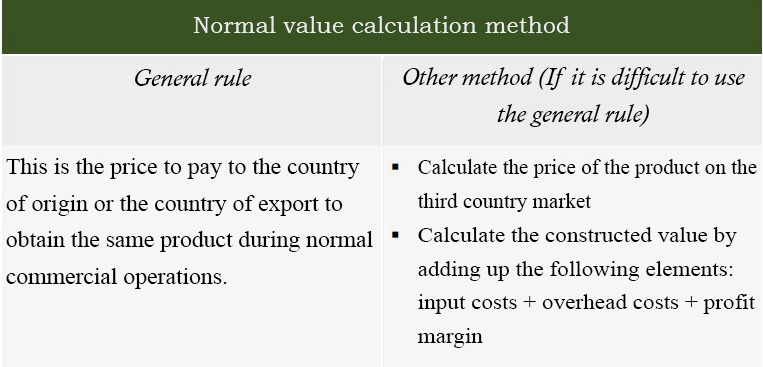

Dumping is a Practice which consists of selling a product on the Tunisian market at prices lower than that of the country of origin or country of provenance. To determine the existence of dumping, a comparison must be made between the export price and the normal value of the product in question. The following two tables make it possible to calculate the two values mentioned above.

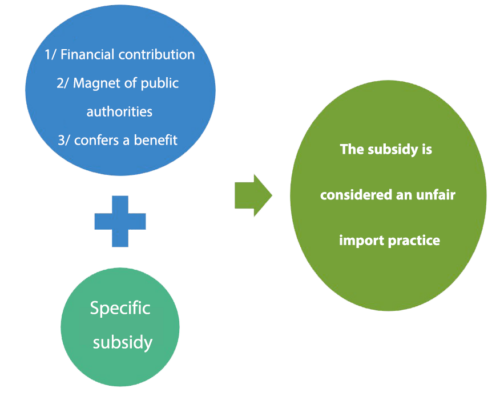

The dumping margin rate is calculated on the basis of the following formula:

An anti-dumping measure may be applied if the volume of the dumped imports represents

Import safeguards measures

Import safeguards measures are taken by the the Ministry of Trade and Export Development after consulting with the National Foreign Trade Council. They consist of raising customs duties or applying a quantitative restriction or a tariff quota.

This makes it possible to deal exceptionally and urgently with a massive increase in imports of a given product causing serious injury or the threat of serious injury to a domestic industry that locally manufactures a similar or directly competitive product.

In order to be able to take safeguard measures, it is essential to fulfill the following conditions