The final invoice represents the result of commercial negotiations between the foreign supplier and the importer. It is a standardized commercial document that gives rise to an accounting record. It differs from the “pro-format” invoice since the latter is an estimate presented in the form of an invoice without providing any accounting value.

The final invoice must contain all the information necessary for the smooth running of the transaction, namely:

- The contracting parties and their contact details;

- The designation of the product;

- The unit price and quantity of the product;

- The global price and the settlement currency according to the chosen incoterm;

- The period of validity of the price indicated;

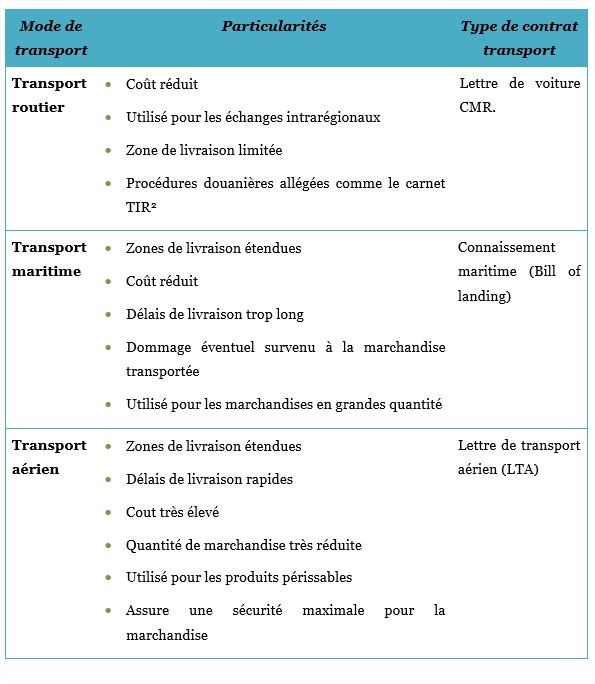

- The means of transport and the delivery time;

- The payment period and any installments received;

- Guarantees and force majeure in the event of an unforeseeable event…