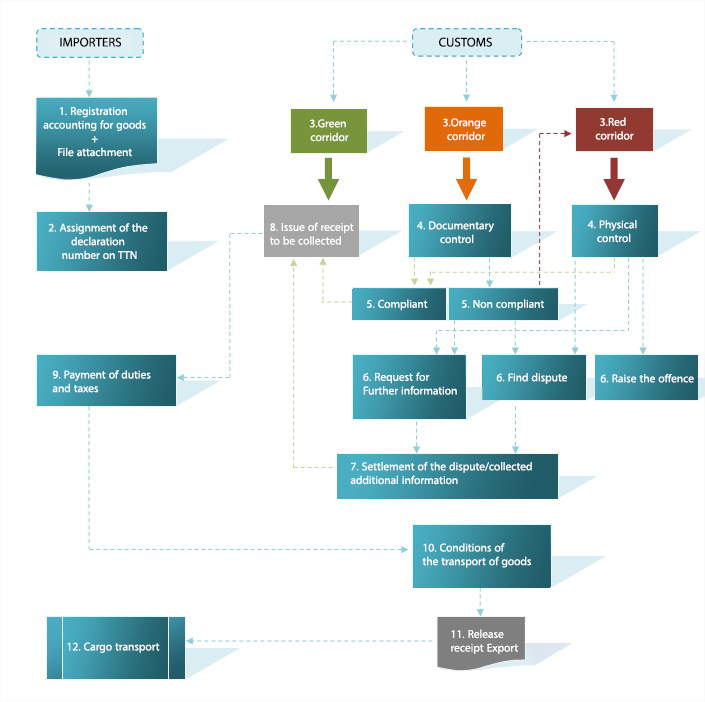

To introduce a good into the Tunisian customs territory from outside for a predetermined use or destination while paying the duties and taxes payable on importation, the economic operator or his agent must follow some specific provisions

Regardless of the registration office, the processing of the detailed declaration is carried out according to the principle of automatic selectivity, thus the customs information system “SINDA” assigns the declaration to a corridor.

- Green Corridor: BAE emission

- Orange Corridor: Documentary Control of the Declaration

- Red corridor: physical control (inspection) of the goods

study and liquidation of the detailed declaration

The study and liquidation of the detailed declaration depends on the customs office of the goods where they were declared, three cases may arise:

Customs formalities