Subsidy is the granting of a benefit to a foreign exporter by the government of the exporting country in the form of a financial contribution that confers a benefit measured against generally applicable trading standards and normal market conditions.

The financial contribution can take one of the following forms:

- A direct transfer of funds (for example a donation, a loan, equity participation)

- A potential direct transfer of funds or liabilities (e.g. a loan guarantee),

- Public revenues that are normally payable are abandoned or not collected (example: tax credits),

- Supplies of goods or services other than general infrastructure, or purchase of goods by public authorities

- Income or price support

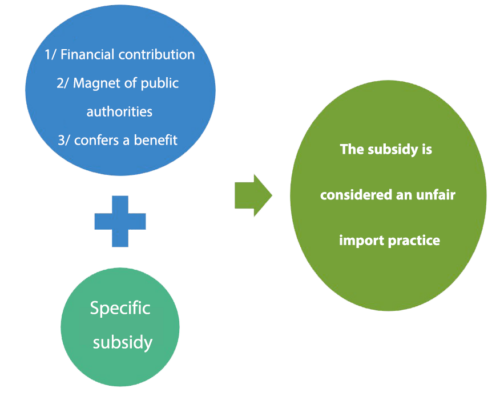

Conditions for considering the subsidy as an unfair import practice

For the subsidy as defined above to be considered an unfair import practice, it must be “specific”, i.e. reserved for certain companies or when its granting is not subject to objective criteria or that these criteria, despite their existence, are not respected.

The imposition of countervailing duties can only be applied on the basis of an investigation which has found that the imports in question are subsidized and are causing damage to the domestic industry producing a like product. The damage determination is based on the following positive evidence:

Countervailing duty investigations must cease immediately in cases where the amount of subsidy is de minimis or where the volume of subsidized imports is negligible.