TCE Banking Domiciliation

Bank domiciliation means the choice by a natural or legal person of an approved intermediary to carry out a transfer of foreign currency (in payment for an import or for another reason) or to send foreign currency in recovery of an export transaction.

Bank domiciliation

The bank domiciliation is made under cover of a TCE foreign trade document which is an administrative document personal to its beneficiary. It is called:

Bank domiciliation

The bank domiciliation is made under cover of a TCE foreign trade document which is an administrative document personal to its beneficiary. It is called:

Bank domiciliation

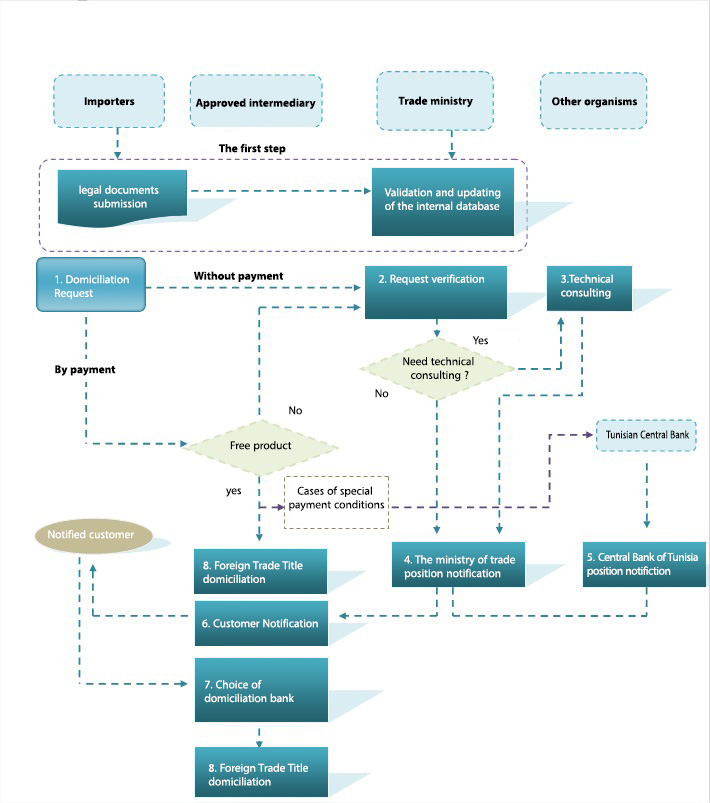

The direct debit request (accompanied by the commercial contract and any other document deemed necessary) is submitted to the authorized intermediary who verifies the content of the invoice and the NGP code of the product to be imported.

Request for authorization without payment: The file is transmitted directly to the Ministry of Trade and Export Development via the TTN application (without going through the approved intermediary) which decides on the latter by possibly transmitting it to another competent structure to technical advice.

The authorized intermediary must respect the regulatory change requirements and obtain the agreement of the central bank in the event that the importation provides for special payment conditions (provisions of the circular of the BCT to authorized intermediaries No. 94-14 of September 14, 1994).

Following a suitable decision from the Ministry of Commerce and possibly the central bank, the operator can proceed with the domiciliation of his foreign trade title, unless he claims to domicile his title with another approved intermediary.

If it is a product excluded from the freedom of foreign trade regime, the import authorization is transmitted under slip to the Ministry of Trade and Export Development.

Depending on the nature of the product, the Ministry of Trade and Export Development may forward this file to another competent authority for technical advice..

After obtaining the technical opinion, the Ministry of Trade and Export Development mentions its decision to the authorized intermediary who is then, responsible for transmitting this decision to the operator.

For the case of the first import operation of a product excluded from the freedom of foreign trade regime: a legal file must be filed with the Directorate General for Foreign Trade so that it can update its internal databases. This file contains an information sheet, the customs code, a copy of the license, the commercial register and the legal status relating to the importer.

Domiciliation of the Foreign Trade Document