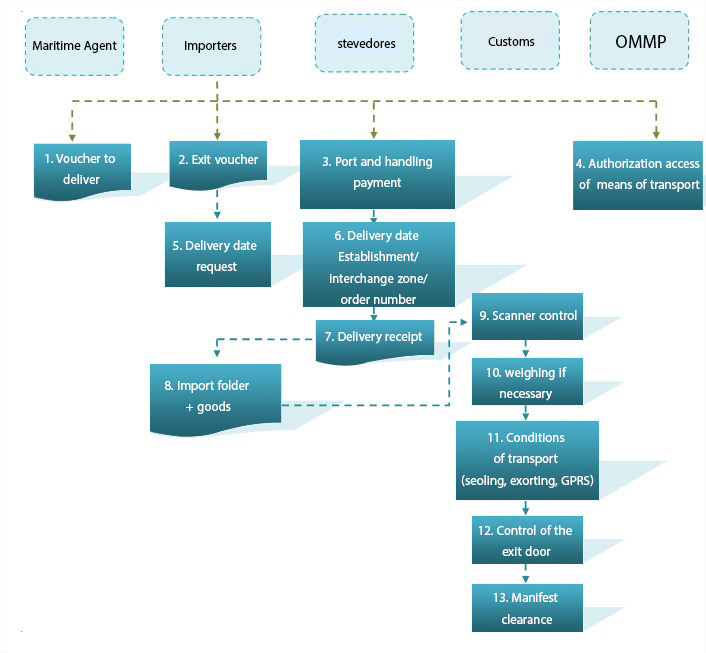

This is the final step in the clearance and release process of goods. In addition to the documents drawn up in the previous phases such as the BAE, the DDM and those required by the special rules, the importer or his authorized representative should complete his import file by obtaining the voucher to be issued from the shipping agent, establishing the exit voucher (via the TTN platform for the DDM manifested or via SINDA for the DDM established out of manifest in the case of flammable, or bulky products).

The payment of port and handling charges as well as the authorization of access to means of transport with the port authority. The Order of the Minister of Transport and the Minister of Trade and Crafts of 16 January 2014 approving the maximum rate for charge, uncharge, handling and securing goods in commercial seaports. The date of delivery of the goods should also be fixed with the stevedore; the latter validates this date by specifying the associated zone and the order number at the entrance of the port. On the day of the meeting, the stevedore identifies the importer’s own charging unit and issues the latter a delivery note. The imported goods pass systematically through the examination of the scanner and then the weighing operation. At the end of this stage, a weighing voucher issued by the customs authorities is delivered to the importer or his representative. If the customs clearance is carried out at the attachment offices or in the stores and customs clearance areas, the conditions for the delivery of the goods are laid down in the voucher to be removed relating to the goods.

The customs departments check the status of these measures before and at the end of the shipment of the goods.

At the exit door, the importer or his authorized representative submit to

the customs the import file containing the following documents:

- The voucher to be removed bearing all necessary visas,

- A copy of the DDM,

- A printout of the exit voucher,

- The weighing voucher,

- Any other document relating to particulate regulation.

If the file submitted is in conformity, the customs authorities may authorize the release of the goods and discharge the port of call and the manifest item corresponding to the charging unit which has been removed.

Procedure for removal of the goods

LES 7 ÉTAPES

DE LA DOMICILIATION BANCAIRE

1.Demande de domiciliation

Réception d’une demande de domiciliation via le système TTN.

2.Vérification

Vérification du contenu de la facture et du code NGP.

3.Transmission

Transmission du dossier au Ministère du Commerce lorsqu’il s’agit d’exportation de produits exclus du régime de la liberté d’exportation.

7.Validation de domiciliation

Validation de la demande de domiciliation (obtention d’un numéro de référence et d’une date de domiciliation)

6.Accord de la BCT

Obtention de l’accord de la BCT.

5.Visa

Visa du Ministère du Commerce

4.Contrôle de la conformité

Statuer sur la nécessité d’un accord de la BCT dans le cas où l’exportation prévoit des clauses et conditions non conformes à la réglementation des changes.

1.Demande de domiciliation

Réception d’une demande de domiciliation via le système TTN.

2.Vérification

Vérification du contenu de la facture et du code NGP.

3.Transmission

Transmission du dossier au Ministère du Commerce lorsqu’il s’agit d’exportation de produits exclus du régime de la liberté d’exportation.

4.Contrôle de la conformité

Statuer sur la nécessité d’un accord de la BCT dans le cas où l’exportation prévoit des clauses et conditions non conformes à la réglementation des changes.

5.Visa

Visa du Ministère du Commerce

6.Accord de la BCT

Obtention de l’accord de la BCT.

7.Validation de domiciliation

Validation de la demande de domiciliation (obtention d’un numéro de référence et d’une date de domiciliation)